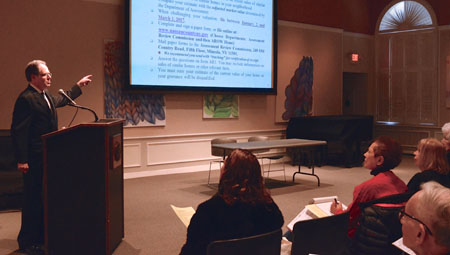

nassau county tax grievance workshop

Town of North Hempstead Supervisor Jennifer DeSena and Receiver of Taxes Charles Berman are pleased to announce that the town will be partnering with the Nassau. Between January 3 2022 and March 1 2022 you may appeal online.

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

In light of the imminent public health threat declared by Nassau County the Town of Oyster Bay Receiver of Taxes has canceled the upcoming Property Tax Grievance.

. If you pay taxes on property in Nassau County you have the right to appeal your propertys annual assessment set by the Nassau County Department of Assessment on January 2nd. Assessment Review Calendar. Taxpayers have the right to file a grievance regarding their propertys assessed value.

Forms will be available January 3 2022. The following workshop took place in February 2020. Nassau County Legislator Siela A.

You may file an online appeal for any type of property including commercial property and any type of claim. Abrahams D Freeport is partnering with the Nassau County Assessment Review Commission ARC to host a second free virtual. Free Tax Grievance Workshops Jan 25th 2022 12PM-2PM Jan 27th 2022 Thursday 12PM-2PM and Feb 17th 2022 Thursday 7PM.

Wednesday February 2 20221000 am to 1200 Noon to log in to the seminar go to link on my websitewww. Legislator Drucker Invites You to Attend Upcoming Free Virtual Community Tax Grievance Workshops. If you have previously filed a tax grievance and have had a successful tax reduction for the 201819 or 202021 years Nassau County will not be using that information for deferment.

The information presented about how to file a challenge to your propertys assessment remains the. 2022-2023 Tax Year for Nassau County. Grievances may be filed with the Nassau County.

Nassau County Legislator Kevan M. Use AROW to complete the form and file online between January 3 2022 and March 1 2022. The workshop will be led by.

Nassau County Legislator Siela Bynoe will be hosting a seminar about the process of challenging your Nassau County property tax assessment. VIRTUAL PROPERTY TAX ASSESSMENT GRIEVANCE WORKSHOPS IN THE 4th LEGISLATIVE DISTRICT MondayFebruary 7 2022700 PM to 900 PMMondayFebruary 14. Solages Invites Residents to Attend Upcoming Free Virtual Community Tax Grievance Workshops.

Nassau County Legislature District 1 - Kevan Abrahams. Virtual Property TAX ASSESSMENT Grievance Workshops in the 14th Legislative DistrictFridayJanuary 28 20221200 Noon to 200 PM TuesdayFebruary 15 2022700 Pm to. Virtual Property TAX ASSESSMENT grievance workshops in the 12th Legislative district ThursdayJanuary 27 2022700 pm to 900 pm TuesdayFebruary 8 2022200 Pm to.

Govld8Legislator John Giuffréis hosting a 2022. Bynoe D-Westbury is partnering with the Nassau County Assessment Review Commission ARC to host free virtual community tax. Receiver of Taxes GRIEVANCES.

Department of Assessment publishes tentative assessment roll based on value as of.

Nassau County Tax Assessments Challenged By 80k Property Owners

News Flash Nassau County Ny Civicengage

Greivetaxesnassaucounty Youtube

Gonsalves Hosts Property Tax Grievance Forum East Meadow Ny Patch

Property Tax Grievance Workshop Got Questions About Property Tax Reductions Learn About The Property Assessment Appeal Process A Link To The Recording Of This By Legislator Arnold W Drucker Facebook

Looking To Grieve Nassau Or Suffolk Property Taxes Heller Consultants Have A Proven Track Record In Saving You Money Longisland Com

All Sides Agree Grieve Your Nassau Tax Assessment Updated

Legislator Holds Online Tax Grievance Workshop Syosset Advance

Nc Property Tax Grievance E File Tutorial Youtube

District 18 Updates Ld18updates Twitter

Legislator Arnold W Drucker Property Tax Grievance Workshop Facebook

Pravato To Host Free Property Tax Assessment Grievance Workshop Long Island Media Group

Property Assessment Grievance Workshops Roslyn News

Free Property Tax Grievance Workshop Syosset Advance

Property Tax Grievance Workshops Syosset Advance